Fall 2025 Newsletter

Can market timing work?

Every once in a while, historically, a robust stock market suffers a correction or even

a crash and then recovers – sometimes quickly, other times over a longer period.

We’ve even experienced such market swings fairly recently.

Some investors may wonder if such a situation presents an opportunity to sell high and buy low. In theory, you should profit considerably if you sell investments at or near a market peak and reinvest when the market bottoms out.

That is correct in theory, but it’s another story in practice.

Predicting the market is risky

You cannot predict, with any consistency, when the market has peaked and is due to fall. Say the market hits a record high, and an investor who is attempting to time the market sells a large proportion of their equity investments. What happens if the market continues to climb? Not only would the investor miss out on the gains, but they would need to reinvest when prices are higher.

That risk is real. Historically, record highs are often an indicator of continued market growth, not necessarily a signal of a market due for a correction. A good example is this year’s performance of Canada’s S&P/ TSX Composite Index, which has recorded multiple record highs in 2025.

Even if a market timer gets lucky and the market plummets after they sell, they can still miss out. To succeed at timing the market, you must guess correctly twice – when to sell and when to buy back in. While you’re waiting for an ideal time to reinvest, the market could rebound quickly.

Investing regularly pays off

By investing on a regular basis, you benefit without having to anticipate the market’s direction. When markets are down, you purchase more shares or fund units at lower prices. In rising markets, you participate in the growth without overinvesting when prices are higher.

EDUCATION PLANNING

How to make tax-efficient RESP withdrawals

When it comes to withdrawing funds, your Registered Education Savings Plan (RESP) is different from any other registered plan. It’s all because an RESP is composed of two pools of funds – one pool is taxable, and the other is non-taxable.

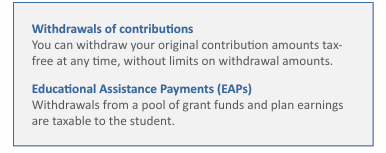

Your original contributions make up the non-taxable pool. This pool is your money. You can withdraw funds from this pool at any time, in any amount and for any purpose.

The taxable pool consists of Canada Education Savings Grant (CESG) funds, any provincial grant funds and plan earnings. Withdrawals from this pool are called Educational Assistance Payments (EAPs), and the amounts are taxable to your child as income while they’re a student.

You choose the pool, or pools, for each withdrawal.

Withdrawal strategies

Over the years of your child’s post-secondary education, you have two goals when withdrawing funds from your RESP. First, you want to minimize or potentially avoid having your child pay tax on withdrawals. Second, you want to completely use up the taxable pool that includes grant money and plan earnings. Should funds remain in the taxable pool after your child graduates, you must repay the remaining grant money to the government if you close the plan.

When annual income is low. Your child can have an annual income up to the basic personal amount ($16,129 for 2025) plus the amount of their tuition tax credit without owing tax. In years when your child’s income is lower, you have the opportunity to make larger withdrawals of EAPs and remain under the taxable threshold. Some students never have to pay tax on RESP withdrawals.

When annual income is higher. Your child could have a year when they owe tax on earned income if they have a well-paying spring and summer job, a paid internship or a co-op work term. By taking withdrawals of contributions, they won’t also have to pay tax on their RESP withdrawals. However, keep in mind that you want to eventually take enough EAPs to use up the taxable pool of funds.

When education costs are lower. In some cases, education costs end up being lower than you expected. Maybe you budgeted for your child moving away for school, but they chose a local university and live at home. Or you saved for four years of a university program, and your child enrols in a two-year college program. In this case, your primary goal is not saving tax on withdrawals – it’s to deplete the pool of grant money and plan earnings. Paying tax on withdrawals at your child’s tax rate is better than possibly forfeiting the grant money.

The December manoeuvre

Sometimes, it seems like a guessing game trying to choose an RESP withdrawal: Should it be a tax-free return of capital, taxable EAPs, or a combination of the two?

Say you’re making an RESP withdrawal in February. You don’t know what your child’s income will be from a job this summer. If it’s high, and you withdraw taxable funds, your child may owe tax this year.

But making an RESP withdrawal in December is a different story. Now you know your child’s taxable income for the current year. Is their income less than the basic personal exemption? If so, subtract the taxable income from the 2025 basic exemption of $16,129, and you can withdraw the resulting amount as an EAP. Your child will not owe tax.

This manoeuvre can also make future withdrawal decisions easier, as you’ll have a lower amount of taxable funds to withdraw strategically.

RETIREMENT PLANNING

Investing in the retirement risk zone

The zone begins several years before you plan to retire and lasts until several years after you retire, and the risk is the market suffering a significant downturn during this critical period.

What if someone is a year from retiring, a market crash erases 20% of their savings, and they feel they have to postpone their retirement? Or what if a recent retiree faces a plummeting market and is forced to draw income from investments that have lost value?

Fortunately, several strategies exist to help safeguard your savings in the retirement risk zone. The solution is personal – what works for one investor may be different for another. A variety of factors determine which strategy suits your situation, including your retirement income sources, risk tolerance, net worth, marital status, desired retirement lifestyle and estate plans.

Shifting asset allocation

One strategy is to increase a portfolio’s fixed-income investments while decreasing equity investments in the period before retirement. The shift happens gradually over several years to reduce the risk of selling a substantial portion of equities in a down market. An individual can also help make the transition by only investing in fixed income during the years leading up to retirement.

This strategy serves to illustrate why the solution is personal. Shifting asset allocation may suit a conservative investor who will have a workplace pension to help provide retirement income. However, this fixed-income-based strategy might not suit a more risk-tolerant investor who is counting on investment growth to help fund a hopefully long retirement.

Building a cash reserve

Another strategy is to create a reserve of cash equivalents and low-risk fixed-income investments in the years before you retire. This way, if the market suffers a correction or crash during the initial years of your retirement, you can use the reserve to provide income while you give the market a chance to recover. The cash reserve, also called a cash wedge, typically covers your cost of living for a couple of years or more, and some retirees choose to replenish the reserve throughout retirement.

Other strategies are available to help you navigate the retirement risk zone. When retirement approaches, we’ll work with you to determine which solution suits your financial situation and gives you peace of mind.

FAMILY FINANCE

When your parents may need your help

As your parents age, they may need assistance getting groceries or taking care of the house, but they might also need help with their financial life.

Here are some important financial and wealth planning matters you may want to find out about. Talking to parents about their finances isn’t always easy, but managing any potential issues now is better than waiting until a problem arises.

Are their wills up to date? Some people go a great many years, even a couple of decades, without reviewing their will. While looking over their will, your parents should ensure they’re still content with their choice of primary and alternate executors (personal representative, liquidator or estate trustee, depending on the province).

Find out about the power of attorney. Ask your parents if they have a power of attorney for financial affairs, known as a mandate in Quebec, should they become unable to manage their finances. Some people believe their spouse or child can fulfill this role without making a power of attorney, but in that case, a family member must apply to the courts for guardianship.

Can they cover health care costs? Though this topic may be difficult to address, it’s helpful to know whether your parents can afford private health care if that support becomes necessary to continue living at home.

Warn your parents about fraud. Scammers commonly target seniors. Have your parents be wary of any request for money or personal identification made by mail, email, phone, online or at the door. Emphasize that fraudsters can appear to be legitimate — for example, claiming to be a representative of the Canada Revenue Agency (CRA).

FINANCIAL BRIEFS

Have the lower-income spouse invest

If you and your spouse are in different tax brackets, here’s an easy and highly effective way to save tax on income and growth of non-registered investments.

The lower-income spouse has less income available to invest, especially when both spouses cover household expenses. With this strategy, the higher income spouse pays all the couple’s or family’s household expenses and their spouse’s personal expenses. Now the lower-income spouse has more money to invest. When they invest these freed up funds in a non-registered account, the investments are taxable at the lower-income spouse’s more favourable tax rate.

To make this method even more effective, the higher-income spouse can pay their spouse’s income tax owing – freeing up more money for the lower income spouse to invest.

With this strategy, you and your spouse may want to keep separate bank and investment accounts, in case the Canada Revenue Agency (CRA) wants to know about the lower-income spouse’s ability to invest.

Using the principal residence exemption

Many Canadians’ largest tax break is not having to pay tax on the capital gain when they sell their home, thanks to the principal residence exemption.

Here are three questions that come up.

Can you claim the principal residence exemption more than once? Yes, you can claim one principal residence per calendar year, even when you sell your second, third or subsequent home.

What’s the criteria for claiming a vacation property? Some vacation property owners want to designate the property as their principal residence for years when it had a larger capital gain than their home. Though the term is “principal” residence, an eligible property only has to be “ordinarily inhabited in the year” by the owner or the owner’s spouse or child. Just living in the cottage, cabin or chalet for a short period qualifies.

What are the reporting rules? You report the sale of your principal residence when you file your tax return for the year you sell the property. You designate the property on Schedule 3, “Capital Gains or Losses” and complete Form T2091 (IND), “Designation of a Property as a Principal Residence by an Individual.”

The mini-RRIF strategy

The latest age to convert a Registered Retirement Savings Plan (RRSP) to a Registered Retirement Income Fund (RRIF) is 71, but you may want to open a RRIF at 65.

You can take advantage of a strategy that saves you tax each year from ages 65 through 71.It’s based on the federal pension income tax credit, which allows you to claim 15% on $2,000 of eligible pension income. A provincial pension income tax credit is also available (except in Quebec), with the percentage varying by province.

Here’s how it works. At age 65, you open a RRIF and transfer $14,000 from your RRSP to your RRIF. From ages 65 to 71, you withdraw $2,000 annually from your RRIF, claiming the pension income credit each year. If you don’t need the $2,000 RRIF withdrawals as income, you could contribute the funds to your Tax-Free Savings Account (TFSA) or a non-registered account.

From age 72 onward, you can continue to claim the annual tax credit on the first $2,000 of your RRIF withdrawals.

This newsletter has been written (unless otherwise indicated) and produced by Jackson Advisor Marketing. © 2025 Jackson Advisor Marketing. This newsletter is copyright; its reproduction in whole or in part by any means without the written consent of the copyright owner is forbidden. This is not an official publication of iA Private Wealth and the information in this newsletter does not necessarily reflect the opinion of iA Private Wealth Inc. The information and opinions contained in this newsletter are obtained from various sources and believed to be reliable, but their accuracy or reliability cannot be guaranteed. The opinions expressed are based on an analysis and interpretation dating from the type of publication and are subject to change. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. Readers are urged to obtain professional advice before acting on the basis of material contained in this newsletter.

Mutual funds are not guaranteed and information on returns is based on past performance which may not reflect future performance. Mutual funds may be associated with commissions, trailer fees, management fees and other expenses. Please read the prospectus. Important information regarding mutual funds may be found in the simplified prospectus. To obtain a copy, please contact your Investment Advisor.

iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates. iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Canadian Investment Regulatory Organization. Only products and services offered through iA Private Wealth Inc. are covered by the Canadian Investment Protection Fund.

Posted In: PostsNewsletter