August 2025 Market Snapshot

Monthly Overview

July saw stocks continue their upward trend, with Canada’s main stock index and the S&P 500 rising for the third straight month, and the Nasdaq for the fourth. This rally pushed the TSX, S&P 500, and Nasdaq to new record highs, bouncing back from the post-Liberation Day selloff. The market was lifted by easing tariffs and trade tensions, a strong start to the earnings season, and a resilient macroeconomic backdrop. Positive developments in the AI sector, increased deal activity, and the passage of the Big Beautiful Bill also helped boost market sentiment. Despite some worries about rising interest rates, the market stayed optimistic, supported by strong economic data.

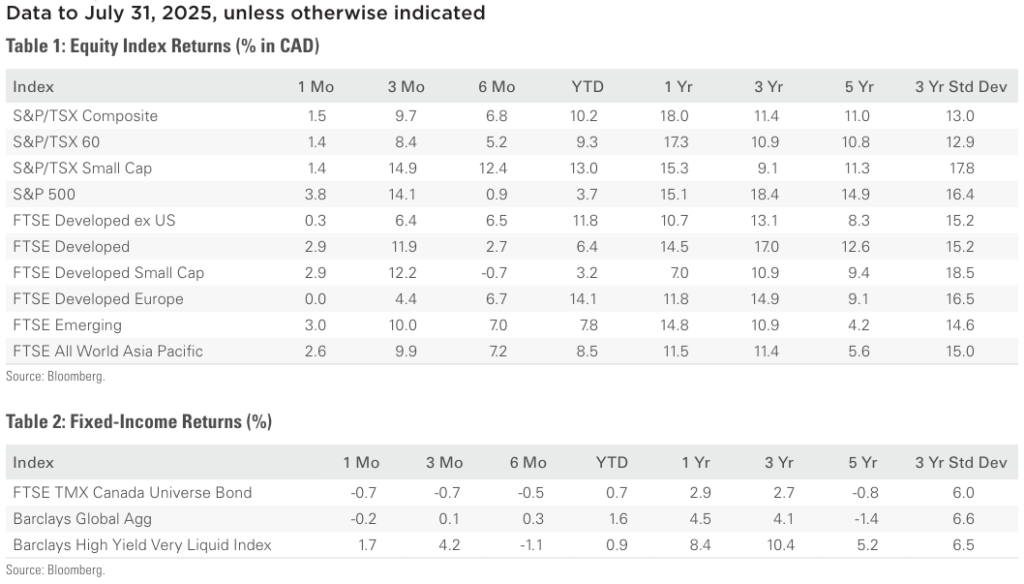

Canada’s benchmark index was 1.5% higher in July, as nine underlying sectors were positive during the month. The gain was led by telecommunication services and information technology, rising 5.0% and 4.5%, respectively. Small-cap stocks, as measured by the S&P/TSX SmallCap Index, rose 1.4% for the month.

The U.S. dollar appreciated 1.8% versus the loonie in July, boosting the returns of foreign markets from a Canadian investor’s standpoint. Note that all returns in this paragraph are in CAD terms. U.S.-based stocks, as measured by the S&P 500 Index, gained 3.8% in July. Nine of the benchmark’s underlying sectors were in the green during the month, with information technology leading the gain with a 6.9% return. International stocks, as measured by the FTSE Developed ex-US Index, were up 0.3% during the month, while emerging markets rose 3.0%.

The investment grade fixed income indices we follow were mixed in July. Canadian investment grade bonds, as measured by the FTSE Canada Universe Bond Index, fell 0.7% during the month, while the key global investment grade bond benchmark lost 0.2%. Global high-yield issues gained 1.7%.

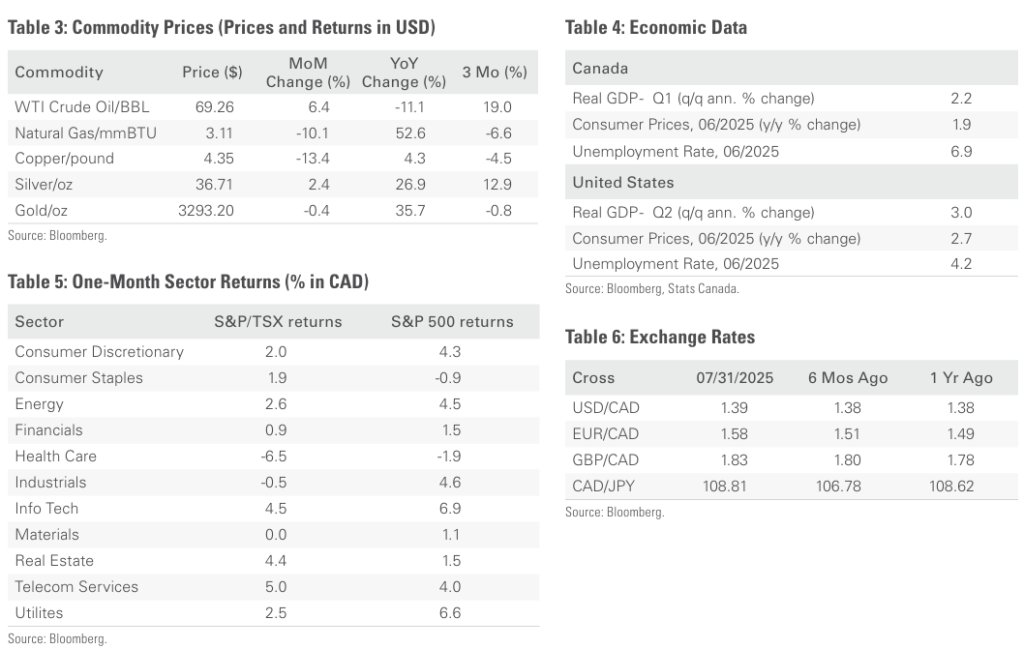

Turning to commodities, natural gas prices fell 10.1% during the month, while the price of a barrel of crude oil gained 6.4%. Copper and gold had a negative month, dropping 13.4% and 0.4%, respectively, while silver gained 2.4%.

Inflation in Canada came in at 1.9% year-over-year in June, up from the 1.7% print in May. The uptick was due to gasoline prices falling to a lesser extent in June and faster price growth for passenger vehicles and furniture. The Canadian economy added 83,000 jobs in June, as the nation’s unemployment rate improved to 6.9%. The Bank of Canada held its overnight interest rate steady at 2.75% for the third consecutive meeting thanks to a recent rise in inflation and a fall in unemployment.

U.S. nonfarm payrolls grew by 143,000 in June, and the unemployment rate improved to 4.1%. The consumer price index rose 0.3% in June, putting the 12-month inflation rate at 2.7%. Energy costs turned higher last month while food prices also came in on the hotter side. The Federal Reserve left its key interest rate unchanged, a widely expected move that comes despite enormous pressure from the Trump administration to lower it. The Fed, in a statement announcing the decision, said that economic growth had moderated in the first half of the year but that inflation remained “somewhat elevated.”

Content sourced from Bloomberg

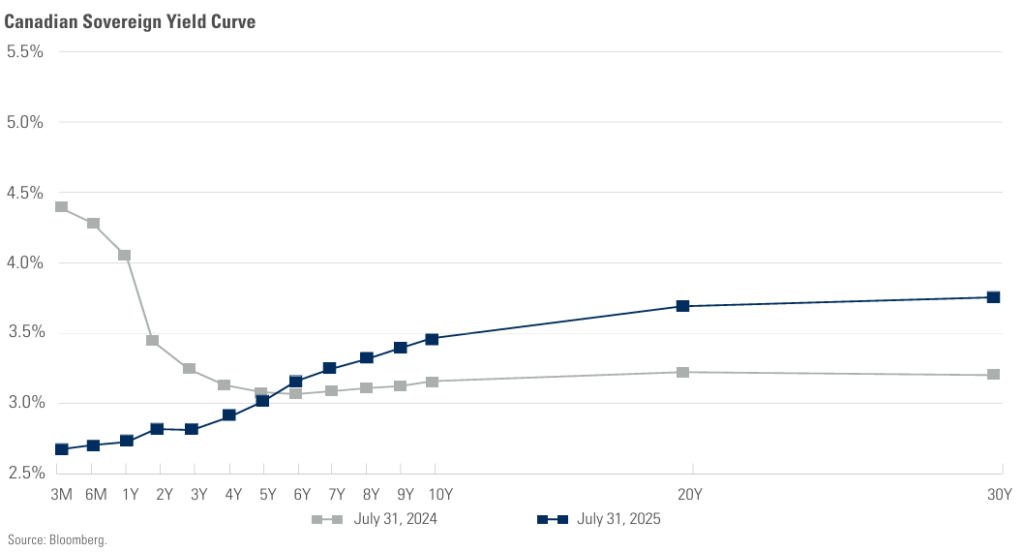

Chart of the Month

Monthly Market Statistics

This document was prepared by the Investment Products & Platforms Team. The opinions expressed in this document do not necessarily reflect the opinions of iA Private Wealth Inc.

Although the information contained in this document comes from sources, we believe to be reliable, we cannot guarantee its accuracy or completeness. The opinions expressed herein are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Nothing contained herein constitutes an offer or solicitation to buy or sell any of the securities mentioned. Specific securities discussed are for illustrative purposes only. The information contained herein does not apply to all types of investors. The information provided herein does not constitute financial, tax or legal advice. Always consult with a qualified advisor prior to making any investment decisions.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. The indicated rates of return include changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that would have reduced returns. Returns for time periods of more than one year are historical annual compounded returns while returns for time periods of one year or less are cumulative figures and are not annualized. Where applicable, compound growth charts are used only to illustrate the effects of a compound growth rate and are not intended to reflect future values or returns of a fund. A mutual fund’s “yield” refers to income generated by securities held in the fund’s portfolio and does not represent the return of or level of income paid out by the fund. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated. The information presented herein may not encompass all risks associated with mutual funds. Important information regarding mutual funds may be found in the simplified prospectus. Please read the simplified prospectus for a more detailed discussion on specific risks of investing in mutual funds. To obtain a copy, please contact your Investment Advisor.

iA Clarington Funds are managed by IA Clarington Investments Inc. a wholly owned subsidiary of Industrial Alliance Insurance and Financial Services Inc., a life and health insurance company which operates under the trade name iA Financial Group. iA Private Wealth Inc. is also a wholly owned subsidiary of Industrial Alliance Insurance and Financial Services Inc. iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Canadian Investment Regulatory Organization. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.

Posted In: PostsMarket UpdatesInvestment Advisors