April 2024 Market Snapshot

Monthly Overview

Stocks rose in March, wrapping up a quarter where markets soared on optimism for an economic “soft landing” and excitement surrounding the opportunities in artificial intelligence. The Nasdaq Composite, S&P 500 Index and Dow Jones Industrial Average all ended the first quarter with five consecutive months of gains, while all three benchmarks also touched record highs at some point in March. This quarter marked the S&P 500’s strongest start to a year since 2019 and the Dow’s strongest since 2021. The S&P/TSX Composite also reached a new all-time high in March, due to a broad rally in commodities.

Canada’s benchmark index was up 3.8% over the month and posted a 5.8% gain in the first quarter. Nine of the benchmark’s 11 underlying sectors were positive during the quarter, led by health care’s 17.7% return. With a decline of 10.0%, the telecommunication services sector was the weakest performer for the quarter. Small-cap stocks, as measured by the S&P/ TSX Small Cap Index, gained 7.2% over the quarter.

The U.S. dollar appreciated by 2.2% versus the loonie during the quarter, slightly boosting the returns of foreign markets from a Canadian investor’s standpoint. Note that all returns in this paragraph are in Canadian-dollar terms. U.S.-based stocks, as measured by the S&P 500, rose 2.8% in March and finished the quarter higher by 12.9%. All underlying sectors were in the green for this quarter, led by telecommunication services and information technology, with returns of 18.5% and 15.3%, respectively. International stocks, as measured by the FTSE Developed ex US Index, rose 7.1% during the quarter, while emerging markets rose 4.3%.

The investment-grade fixed income indices we follow were mixed in the first quarter. Canadian investment-grade bonds, as measured by the FTSE Canada Universe Bond Index, were down 1.2% during the quarter. The key global investment-grade bond benchmark was down 2.1%, while global high-yield issues were up 1.3%.

Turning to commodities, natural gas tumbled 29.9% in the quarter, while the price of crude oil rose 16.1% in the same period. Gold, silver and copper all had a positive quarter, with respective gains of 7.0%, 3.4% and 3.0%.

Inflation in Canada rose 2.8% year-over-year in February, down from 2.9% year-over-year in January. Notable contributors to this deceleration included cellular services, food purchased from stores, and internet access services. The Canadian economy added 41,000 jobs in February, but the nation’s unemployment rate rose to 5.8%. The Bank of Canada maintained its key overnight rate at 5.0%, while stating that it will continue with quantitative tightening of its monetary policy to help control inflation.

U.S. nonfarm payrolls rose by 275,000 in February, but the unemployment rate climbed to 3.9%. The U.S. consumer price index increased 3.2% year-over-year in February. Driving the increase in the annual inflation rate was a 2.3% jump in energy prices. The Federal Reserve’s preferred inflation gauge, the Personal Consumption Expenditures price index, was up 2.5% year-over-year in February. The Federal Reserve maintained its policy rate at the current range of 5.25% to 5.5%, marking the fifth consecutive meeting at which the Fed has opted to hold interest rates steady.

Content sourced from Bloomberg; as at February 29, 2024.

Chart of the Month

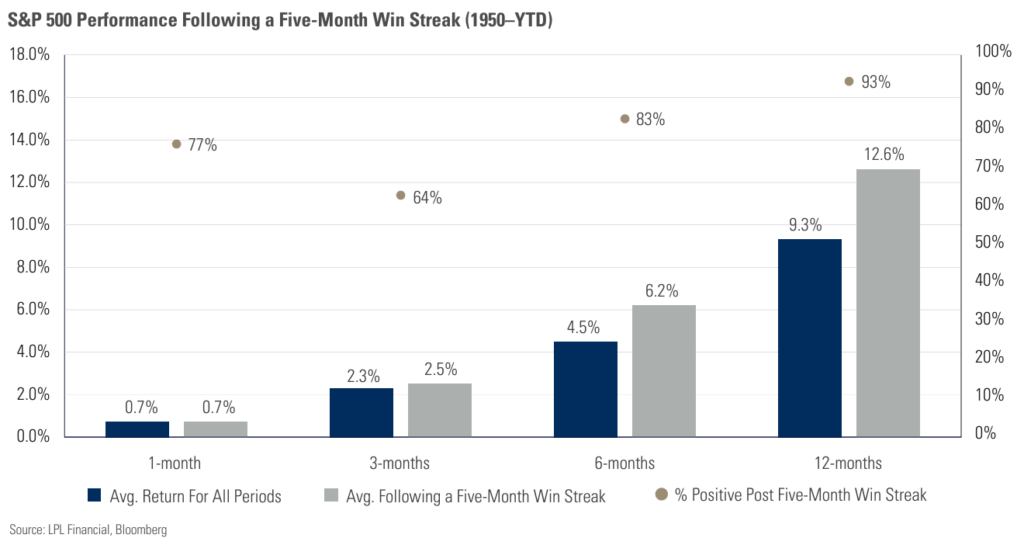

As the first quarter of 2024 draws to a close, the S&P 500 continues its impressive streak, marking its fifth consecutive month of gains and a 25% surge in this period. This rapid surge has sparked concerns among investors about whether the market has moved too far too quickly. However, history shows winning streaks of this magnitude are not only rare but provide another positive sign for stocks. Since 1950, there have only been 30 occurrences when the S&P 500 rose for at least five consecutive months. Looking back at these occurrences, forward returns have been notably positive, with average and median 12-month gains hovering around 12%. That is materially higher than the average return over 12 months looking back at all such periods going back to 1950, and a similar patter in seen over shorter timeframes as well. Moreover, the S&P 500 traded higher twelve months later a staggering 93% of the time after rising for five straight months. The recent rally may cause some new investors to question whether the market is overvalued and poised for a correction, however, history indicates that robust momentum can persist for an extended period.

This document was prepared by the Investment Products & Platforms Team. The opinions expressed in this document do not necessarily reflect the opinions of iA Private Wealth Inc.

Although the information contained in this document comes from sources, we believe to be reliable, we cannot guarantee its accuracy or completeness. The opinions expressed herein are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Nothing contained herein constitutes an offer or solicitation to buy or sell any of the securities mentioned. Specific securities discussed are for illustrative purposes only. The information contained herein does not apply to all types of investors. The information provided herein does not constitute financial, tax or legal advice. Always consult with a qualified advisor prior to making any investment decisions.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. The indicated rates of return include changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that would have reduced returns. Returns for time periods of more than one year are historical annual compounded returns while returns for time periods of one year or less are cumulative figures and are not annualized. Where applicable, compound growth charts are used only to illustrate the effects of a compound growth rate and are not intended to reflect future values or returns of a fund. A mutual fund’s “yield” refers to income generated by securities held in the fund’s portfolio and does not represent the return of or level of income paid out by the fund. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated. The information presented herein may not encompass all risks associated with mutual funds. Important information regarding mutual funds may be found in the simplified prospectus. Please read the simplified prospectus for a more detailed discussion on specific risks of investing in mutual funds. To obtain a copy, please contact your Investment Advisor.

iA Clarington Funds are managed by IA Clarington Investments Inc. a wholly owned subsidiary of Industrial Alliance Insurance and Financial Services Inc., a life and health insurance company which operates under the trade name iA Financial Group. iA Private Wealth Inc. is also a wholly owned subsidiary of Industrial Alliance Insurance and Financial Services Inc. iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Canadian Investment Regulatory Organization. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.

Posted In: PostsMarket Updates