iA Clarington Investments 2022 Market Outlook

Year Ahead

It is a fascinating time for the global economy. We are coming off a pandemic, close to eight billion vaccine doses have been administered worldwide as of this writing,¹ the world has broadly reopened (but cases are still surging in some spots), and consumption of goods is back in full force. The global supply chain, being as tightly knit as it’s ever been, is now under a lot of stress and the hottest data point is the number of ships waiting at anchor in global ports. And then there’s inflation – the logical consequence of the sequence of events over the last two years – which is sitting at a 30-year high despite ample slack in the labour market.

If 2020 was the year of the virus (alternatively, the year of the stimulus) and 2021 was the year of the vaccine, it would be fair to label 2022 as the year of uncertainty. There are no comparable years in the history books to guide an economist in his forecasting exercise right now, and so much hangs on how the Federal Reserve (Fed) navigates through the fog.

So, let’s fall back on the known facts. First, consumers are flush with cash in the developed world, and spending should remain healthy. Businesses are willing and able to invest more in their production capacities and inventories, meaning that absent another major shock – from the omicron variant, for example – global GDP should continue to chug along. Global equities are also well positioned for further gains, as earnings on the MSCI All Country World Index² are expected to grow about 20% in 2022. Global rates should continue to climb, as many central banks have already started tightening their policies.

Against this backdrop, the U.S. economy is somewhat of an outlier, with a red-hot consumer that has been fueled by probably one-too-many stimulus packages in early 2021. We feel that inflation worries are more warranted south of the border, as the U.S. is now dealing with a demand problem on top of the global supply chain issues, leading to empty shelves and skyrocketing used car prices. The Fed, with its dual mandate of price stability and maximum employment, is stuck between the proverbial rock and a hard place, and its course of action will weigh heavily on risk sentiment next year. Tapering of quantitative easing has finally started and should run through the summer, while rate hikes should follow in the back end of the year. How many hikes will we see? It’s uncertain, but right now we’re anticipating one or two.

In our view, the Canadian economy (and market) should continue to shine in 2022, with its healthy labour market creating the bedrock for solid, sustainable growth. This backdrop also puts the Bank of Canada in a much easier stance to move ahead with some normalization of its monetary policy, and it should be well positioned to hike earlier, and at a faster pace, than the Fed. This bodes well for the loonie, which we would not be surprised to see hit 88–90 cents by year-end.

While the easy picking is clearly behind us, we still see the coming year as favourable for equities over bonds. Canada and emerging markets are well positioned to outperform, while the U.S. market already seems a bit expensive, in our view. As global rates remain historically low, 2022 could be another challenging year for bonds, although years of negative returns (like 2021) are uncommon. The key to adding value in 2022 will be active management and asset allocation, as well as a good dose of discipline.

– Sébastien Mc Mahon Interim Chief Economist & Senior Portfolio Manager, Diversified Funds IA Investment Management Inc.

Dan Bastasic MBA, CFA

IA Clarington Investments Inc.

IA Clarington Strategic Corporate Bond Fund

IA Clarington Strategic Equity Income Fund

IA Clarington Strategic Equity Income Class

IA Clarington Strategic Equity Income GIF

IA Clarington Strategic Income Fund

IA Clarington Strategic Income GIF

IA Clarington Tactical Income Class

Where are the opportunities?

The script for investing could not have played out better than it has over the past 12 months. The overwhelming liquidity from monetary and fiscal policies helped fuel broad-based returns across most asset classes. The question going forward is: what will the backdrop for investing look like as liquidity declines and economies continue to normalize?

We think everything that peaked in the past year will revert to a higher mean in the coming year. In our view, economic growth and earnings growth will decline from year-ago levels but remain higher than the average growth witnessed pre-pandemic. Inflation will decline from the past year but remain higher than it was in the past 10 years while interest rates will be biased higher from current levels.

We are positioned for this scenario and believe we will find the best opportunities in sectors and companies correlated to economic growth. We will also have lower exposure to fixed-income securities at risk from higher interest rates.

Within equities, we expect to find many opportunities in the industrials and cyclical-related sectors as well as defensive dividend payers. Within fixed income, we still see relative value and superior yield potential in higher-yielding bonds versus investment grade bonds. If this scenario plays out as we expect it to, it should lead to an appreciating Canadian dollar as we approach year-end in 2022.

What are the challenges?

Despite unprecedented fiscal and monetary support, as the economy and earnings normalize, markets will be vulnerable to declines from peak levels of growth coupled with valuations that have not yet fully priced in higher interest rates or inflation.

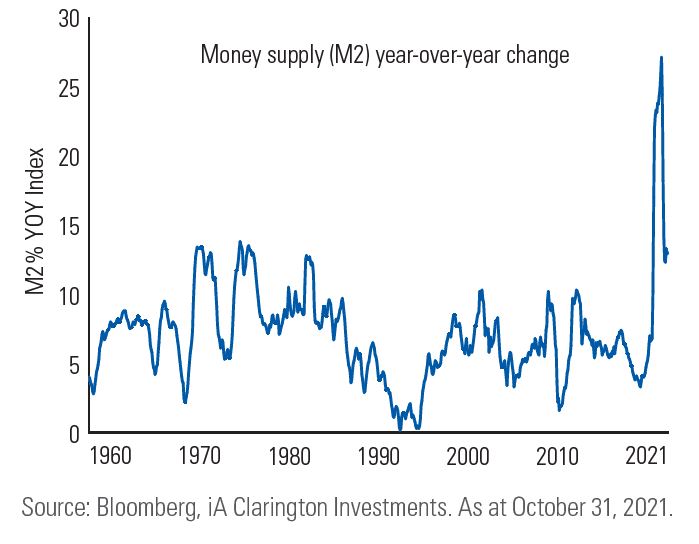

Money supply growth has peaked

Although timing this adjustment is a fool’s game, we expect the first half of the year to be positive overall for returns while the second half will be ripe for this adjustment period to fuel short-term and periodic volatility. We fully expect at least a couple of periods of high volatility with ensuing market corrections as we normalize on many fronts over the next two years. Security selection and allocation will be key to managing risk-adjusted returns during the coming year.

How are you positioning the funds?

Our overall positioning – broad exposure to equities complemented by a higher allocation to high-yield bonds – has not changed materially during the past 12 months. We did adjust our specific positioning within those markets by reducing foreign exposure in favour of Canada, increasing specific security exposure in cyclical parts of the market and reducing exposure to investment grade bonds in favour of higher cash levels.

We enter the beginning of the year with the portfolios tilted towards dividend-paying defensive securities, financials and higher cash levels. Our currency exposure is currently mostly hedged.

Why is this the right approach for 2022?

We strive to produce the best possible risk-adjusted returns over time, and while conditions are favourable for continued positive economic and earnings growth, we believe the most effective approach is to emphasize companies with stable and growing cash flows and dividends while gaining exposure to securities with lower business sensitivity to rising interest rates and inflation. We believe it will be important to hedge foreign currency exposure as the year progresses while focusing on yield from high-yield bonds and undervalued dividend-paying equities.

Matthew J. Eagan MBA, CFA

Eileen N. Riley MBA, CFA

David W. Rolley CFA

Lee M. Rosenbaum MBA

Loomis, Sayles & Company, L.P.

IA Clarington Loomis Global Allocation Class

IA Clarington Loomis Global Allocation Fund

IA Clarington Loomis Global Equity Opportunities Fund

IA Clarington Loomis Global Equity Opportunities GIF

Where are the opportunities?

In equities, we are continuing to find opportunities in uniquely positioned technology companies, consumer companies capturing strong demand for e-commerce, and best-in-class physical retailers with a compelling value proposition. We have exposure to health care companies offering products and services geared toward higher growth areas, or greater revenue visibility and manageable reimbursement risk. We hold a diverse set of financial names with strong competitive positioning and companies across a range of industries with strong network effects.

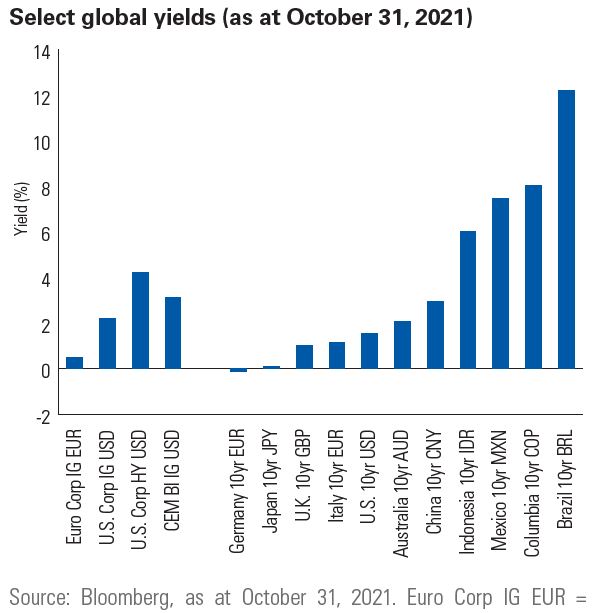

In fixed income, we continue to favour name-specific high yield and crossover issuers with strong liquidity and solid balance sheets along with potential rising star candidates. We also remain selective on emerging market credit, where fundamentals are improving (in hard currency issues and specific opportunities in local currency issues). We remain overweight credit beta with preferred issuer overweight positions, continuing to rely on our fundamental credit analysis capabilities.

We continue to be tilted underweight duration, most notably in the developed markets space, given our view that most major developed market government bonds are expensive and that yields are likely to see some upside pressure as the cyclical upturn gradually progresses, output gaps compress and central banks look to move towards policy normalization.

What are the challenges?

The economic outlook in large part continues to depend on the successful management of the pandemic on a global scale. While the world has made demonstrable progress over the last year, uncertainty persists as infection rates increase in many countries. In addition, there remains a lack of consensus on the duration of antibodies and there is the potential for new variants. The outlook is also reliant on the duration of fiscal and monetary support, and other relief packages, in the U.S. and globally. Supply chain issues and inflation surprises continue to be risks. Thus, our focus remains on investing in companies that we believe have the ability to successfully navigate the current environment and generate value over the longer term.

How are you positioning the funds?

IA Clarington Loomis Global Allocation Fund continues to have a majority equity allocation, reflecting our view that valuations are more attractive in equities than fixed income. Within fixed income, we have a larger allocation to non-U.S. than U.S. securities.

In equities, we believe investing in companies that exhibit our three alpha drivers – quality, intrinsic value growth and attractive valuation – creates potential for long-term outperformance. Targeting these alpha drivers allows us to capture two market inefficiencies: mispricing, through our valuation alpha driver, and a ‘duration effect’ through our quality and intrinsic value growth alpha drivers. We define the ‘duration effect’ as a high-quality company’s ability to add value over time through the compounding of its cash flows.

Portfolio positioning continues to be driven by where we are finding our best ideas. We currently have significant exposure to the information technology, consumer discretionary and health care sectors. Conversely, we do not have any direct exposure to the utilities, real estate and energy sectors.

In fixed income, although investment grade corporate credit spreads look fair-to-slightly-rich, we still like the yield advantage they offer. The fundamental backdrop, underpinned by solid corporate profit growth, and the technical backdrop remain supportive.

Our primary U.S. dollar view is for moderate softening as global growth starts to catch up to the U.S. Healthy investor risk appetites and cyclical improvement abroad are typically consistent with a weaker dollar. Rising twin deficits and higher commodity prices are additional headwinds for the dollar.

Why is this the right approach for 2022?

We believe asset allocation shaped by our best global alpha opportunities can generate attractive long-term risk-adjusted return potential. We allocate capital by leveraging our core competency in fundamental research, which we believe is a more effective method than trying to correctly predict macroeconomic variables, which may be backward looking and not correlated with returns.

We continue to be underweight duration given our expectation for government bond yields to rise alongside continued economic expansion as the Fed normalizes its policy rate. Inflation is anticipated to keep pace in both Europe and the U.S. Credit spreads are historically tight with little room to narrow. Nevertheless, we expect to maintain a modest credit beta overweight given limited high-quality carry alternatives. Lastly, we are cautious on non-dollar forex, as we do not see a catalyst for non-dollar performance until global growth expectations improve.

Jeffrey Adams CFA, CIM, RIS

Wes Dearborn CFA

Kelly Hirsch CFA, Head of ESG

Jeffrey Lew CFA

Marc Sheard CFA

Vancity Investment Management Ltd., IA Clarington Inhance Bond SRI Fund, IA Clarington Inhance Balanced SRI Portfolio, IA Clarington Inhance Canadian Equity SRI Class, IA Clarington Inhance Global Equity SRI Class, IA Clarington Inhance Global Equity SRI Class, IA Clarington Inhance Growth SRI Portfolio, IA Clarington Inhance Moderate SRI Portfolio, IA Clarington Inhance Monthly Income SRI Fund, IA Clarington Inhance Monthly Income SRI GIF,

Where are the opportunities?

It has been a year of extraordinary growth and unforeseen headwinds. The rollout of the vaccine during the first half of the year precipitated the release of pent-up demand that fueled the economic recovery and led the U.S. stock market to all-time highs. Simultaneously, the emergence of the delta variant slowed global reopening and exacerbated the extreme backlog in the supply chain, leading to higher rates of inflation with headline and core inflation hitting multi-decade highs in the U.S.

Global consumers, who were locked down at home for extended periods, collectively looked to splurge on capital goods (cars, home repairs, etc.) and services (restaurants, travel, etc.). Consequently, the global supply chain, which was already facing myriad issues, was unable to keep up. The average transit time for a product to get from Shanghai to Los Angeles more than doubled from what was typical pre-pandemic.

Companies that have strong audit programs for environmental, social and governance (ESG) factors throughout their supply chains tend to be more resilient to supply chain disruptions. This monitoring helps them understand where key components of their supply chain are sourced and can help them be proactive in managing shortages and delays. This will be especially important in the coming year as supply chain pressures, while likely to ease somewhat, do appear poised to persist with extreme weather events, pandemic-related disruptions and human rights-related import bans continuing to complicate the movement of goods worldwide.

As in most years, within the equity markets there are areas of over-valuation and under-valuation; however, we continue to identify opportunities that fit our process of investing in high-quality, ESG-leading companies with ample runway to reinvest at high incremental returns. Within our five-year view we are currently sourcing potential investments within sectors such as information technology, consumer discretionary and industrials, where temporary issues have pushed valuations down to more reasonable levels when considering potential growth rates.

Fixed-income markets experienced significant volatility in 2021 as interest rates moved higher, reflecting a strong rebound in the economy, elevated inflation, and the reduction of asset purchases by the Bank of Canada. While these conditions create uncertainty heading into 2022, they also present opportunities. The normalization of interest rates across the yield curve increases the potential for higher returns over the long run, while also improving the risk/return relationship between government and corporate bonds. We will look to take advantage of elevated interest rate volatility by continually assessing and reoptimizing positioning along the dynamic yield curve.

Corporate bonds continue to offer the potential for higher total returns compared to government bonds; however, the opportunity for outperformance has declined with relative yields and spreads trading near cyclically narrow levels.

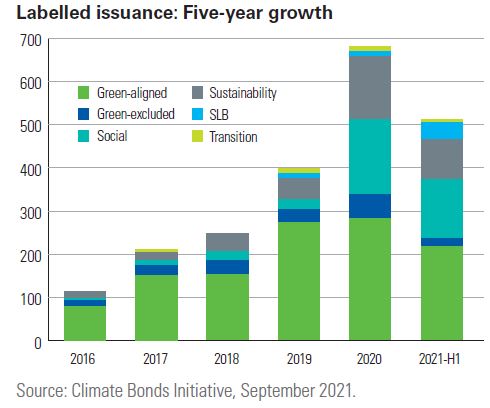

ESG bond issuance has continued to grow rapidly as new government and corporate issuers enter the market (see chart). The evolution of this market provides additional opportunities for ensuring our fixed-income portfolios are invested responsibly and have a positive impact within Canada and around the world.

What are the challenges?

Heading into 2022, the stage is set for a difficult operating environment. Management teams will have to scramble to source inventory and see goods delivered within reasonable timeframes. A tight labour market will also act as a headwind as companies struggle to fill open roles. At the same time, companies will need to maintain a cap on costs as commodity prices, wages and global shipping rates have increased substantially.

We believe that our best guide, particularly in this type of environment, is our bottom-up investment process. The future always contains elements of uncertainty and unpredictable events happen – the last couple of years are a stark reminder of this. Ultimately, we look to own businesses that we believe can survive and even thrive under conditions of intense uncertainty.

The path of inflation in 2022 will be a key variable in determining both the direction of interest rates and the shape of the yield curve. Imbalances generated throughout the economic recovery have created uncertainty, with central banks forecasting that inflation will be transitory, while market-based inflation expectations suggest it may be more persistent. The divergence of opinions means interest rate volatility is likely to continue, with the ultimate outcome having potentially far-reaching implications for central bank policy and long-term growth.

We are confident that consumer demand will remain robust as economies continue to open and consumption normalizes. Although no one has a crystal ball, over time we also expect the supply chain issues to alleviate as elevated demand eases somewhat throughout the year. A key question will be whether the exacerbated inflation picture is transitory as proclaimed by central banks, or newly entrenched, leading to a more permanent situation.

Similar to the Taskforce for Climate Related Financial Disclosures (TCFD), the Taskforce for Nature Related Financial Disclosures (TNFD) is expected to launch by 2023. The benefits of well-functioning ecosystems are estimated to be double the world’s GDP, while losses from the ‘business as usual’ scenario could cost the global economy $10 trillion by 2050. Measuring biodiversity impacts can be even more complicated than measuring carbon emissions and climate impacts. Companies need to be preparing for biodiversity-related disclosures and focused on identifying biodiversity impacts that are material to their operations. We expect to see increasing focus on biodiversity impacts both by regulators and investors in 2022 as TNFD prepares to launch.

How are you positioning the funds?

No matter the environment or macro outlook, we are constantly assessing our investments. We start each day as if operating with a clean slate, evaluating our portfolios without bias. Our goal is to ensure that we are invested in our highest-conviction ideas so that we are optimally positioned to outperform over full market cycles. We invest in companies with a sustainable lens, which includes assessing the sustainability of business models and competitive advantages, so that we are well positioned regardless of economic conditions.

Bond yields in Canada remain attractive relative to other markets and continue to be the primary focus of our fixed-income investments. With increasing uncertainties regarding the path of inflation, we continue to position defensively along the yield curve, with an underweight to the long end. We 2022 Market Outlook remain cautiously optimistic that credit will continue to outperform government bonds; as a result, we are overweight high-quality short-term corporate bonds while maintaining a small exposure to defensive preferred shares. Positive impact bonds have always been a core position for us and we plan to increase our holdings as the market continues to evolve with new green and sustainable bond issuers on the horizon.

The highly anticipated COP26 UN Climate Change Conference held in November led to commitments in high-priority areas such as methane emissions and deforestation. Governments have increased net-zero ambitions, resulting in 80% of global emissions now being covered by net-zero targets. Investors responsible for almost 60% of the world’s managed assets are also committing to net-zero targets. We believe that companies with well-developed climate risk management strategies are best positioned to navigate the evolving regulatory environment and investment landscape.

Why is this the right approach for 2022?

As quality growth investors, we seek out companies that operate in industries with high barriers to entry and provide products or services that are critical to their customers, a combination that leads to strong potential for above-average margins, high returns on capital and strong balance sheets. These characteristics act as a shield, protecting companies from unforeseen events such as the current inflationary environment, as they are likely able to pass on input cost increases. It enables them to weather market downturns, as their balance sheets and recurring revenue profiles will allow them to not only survive but improve their competitive standing against lower-quality peers.

With increasing uncertainty and volatility in fixed-income markets, we believe it is prudent to be defensively positioned along the yield curve and within credit. With our active approach, our current curve positioning and bias towards high-quality short-term corporate bonds will allow us to opportunistically take advantage of any material relative value changes should some of the aforementioned risks be realized in 2022.

ESG integration has always been fundamental to our low-carbon investment process. Our long-standing climate strategy and stakeholder-focused approach helps mitigate unpredictable events, such as increasingly frequent extreme weather events, and benefits from the growing investor focus on ESG issues resulting from the ongoing global pandemic. We believe this strategy will continue to mitigate risks and capture market opportunities over the long term.

Posted In: PostsMarket UpdatesInvesting