Monthly Cash Monitor July 2021

Cash is often a disregarded portion of a portfolio. It is commonly viewed as being a placeholder, something that’s held as an investor transitions from one asset class to another. What seems to be forgotten is that cash is itself an asset class (let’s call it zero duration fixed income), and not giving cash its due could mean leaving dollars on the table. We believe it is important to apply some strategic thinking when it comes to a portfolio’s cash allocation.

Our view is that cash allocations that are likely to be held for more than a very short time should be swept into a cash-equivalent instrument that offers a yield (as small as that might be today). Any of the instruments discussed in the pages that follow are viable alternatives, but in determining which option to go with, one must consider time horizon and liquidity requirements.

If the holding period is unknown and on-demand liquidity is required, the ideal solution today for most clients is a high-interest savings account (HISA). The FundSERV-listed options available through iA Private Wealth currently yield up to 1.00% (Series F). The A-class versions of the HISAs listed in this report pay trailers between 10 bps and 25 bps and offer yields reduced by an equivalent amount. Canadian and U.S.-dollar-denominated HISAs come with CDIC protection and offer T+1 settlement. The options for short-term cash management expand a bit as the time horizon increases and liquidity requirements become less urgent. Of course, yields typically increase as the term increases, and today, investors can access 270-day GICs that yield up to 0.60%.

In money market news, the Bank of Canada left its key interest rate unchanged at 0.25% at its July meeting, indicating it does not expect any hikes before at least the second half of next year, in line with previous guidance.

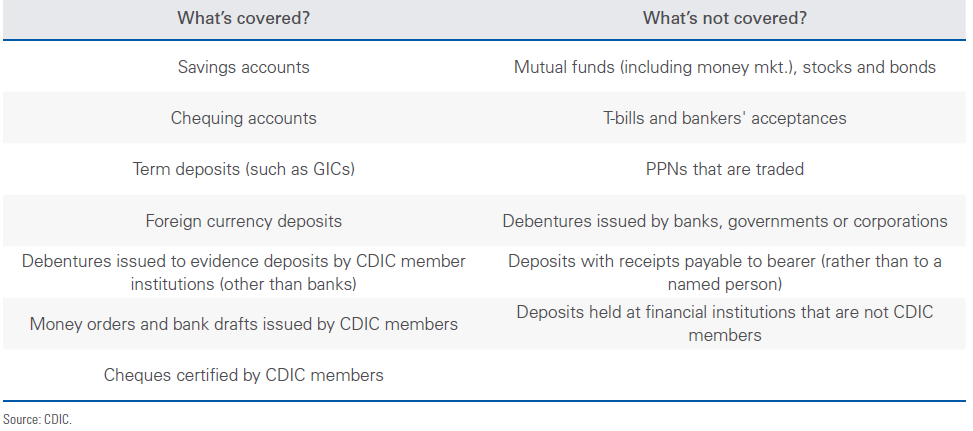

PLEASE NOTE: “High-interest savings” mutual funds and ETFs that are designed to replicate the behaviour of a HISA but without CDIC protection are restricted securities unless additional disclosures are included in the Fund Facts and simplified prospectus around the fact that the products are not CDIC protected.

The CDIC

The CDIC insures eligible deposits up to a maximum of $100,000 per depositor per insured category. Our view in most situations is that eligible deposits exceeding $100,000 should be spread across multiple CDIC members, such that no single account exceeds $100,000. This ensures maximum coverage in the event of a worst-case scenario. Effective April 30, 2020, CDIC protection was expanded to include foreign currency deposits and term deposits with maturity of greater than five years.

Posted In: PostsMarket Updates