Monthly Market Snapshot November 2021

Monthly Overview

After a rough September, stocks rebounded in October with various indices hitting record highs during the month. Gains were fueled by a robust start to the third quarter earnings season in the U.S. and improving COVID-19 trends throughout the world, enabling more economies to gradually reopen. Despite worries of supply disruptions driving up inflation and the potential acceleration of the timing of future rate hikes from central banks, investor sentiment remained upbeat throughout the month.

Canada’s benchmark S&P/TSX Composite Index jumped 4.8%, with seven of the 11 underlying sectors producing gains during the month. The industrials, energy and real estate sectors led the way with respective gains of 8.8%, 8.6% and 6.1%. Health care was the main detractor for the period, with a loss of 6.1%. Small-cap stocks, as measured by the S&P/TSX Small Cap Index, jumped 5.5% for the month.

The loonie was 2.4% higher versus the greenback during the month, dampening returns in foreign equity markets from a Canadian investor’s standpoint. Note that all returns in this paragraph are in CAD terms. U.S.-based stocks, as measured by the S&P 500 Index, climbed 4.5% in October, with all of the benchmark’s underlying sectors in the black. Leading the way were the consumer discretionary, energy and information technology sectors, with respective gains of 8.4%, 7.7% and 5.6%. International stocks, as measured by the MSCI EAFE Index, were flat in the period, while emerging markets faced losses of 1.4%.

The investment grade fixed income indices we follow were lower in October. Canadian investment grade bonds, as measured by the FTSE Canada Universe Bond Index, slipped 1.1% during the month, while the key global investment grade bond benchmark fell by 0.2%. Global high-yield issues retreated 0.3%.

Turning to commodities, the price of a barrel of crude oil advanced 11.4% during the month, topping US$80 a barrel for this first time since 2014. Natural gas slid 7.5%. The price of gold and silver increased 1.6% and 8.6%, respectively, during the period.

In Canadian economic news, the consumer price index accelerated to 4.4% year-over-year in September, the highest reading since 2003. Canadian GDP was up 4.1% year-over-year in August. Canadian employment increased by 157,100 in September, as the nation’s unemployment rate fell to 6.9%. The Bank of Canada announced the end of its quantitative easing program at its October meeting, but left its key interest rate unchanged at 0.25%. Governor Tiff Macklem indicated that the BoC would be considering raising interest rates sooner than previously thought.

The U.S. posted its weakest growth of the pandemic recovery, with GDP expanding at a 2% annualized rate in the third quarter. U.S. nonfarm payrolls increased by 194,000 in September, as the unemployment rate fell to 4.8%. The consumer price index increased 5.4% year-over-year in September. U.S. retail sales in September rose 0.7%.

Monthly Market Statistics

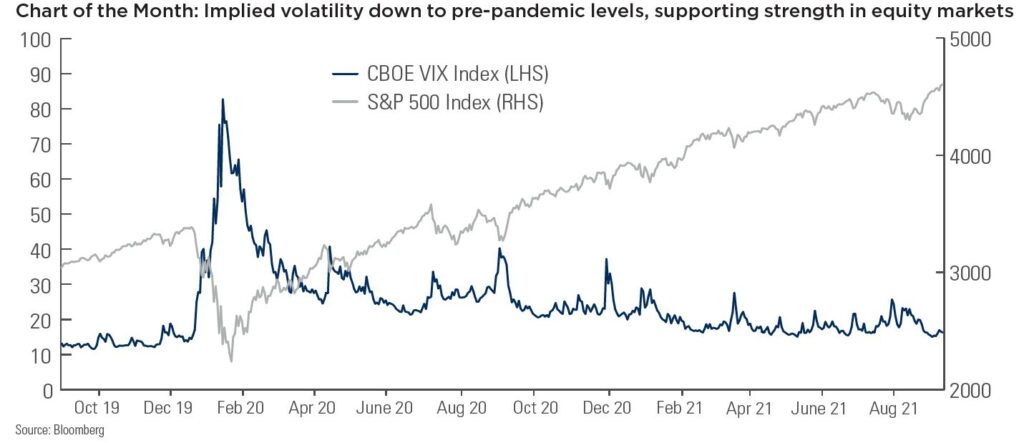

Investor confidence in equity markets is back to pre-pandemic levels with major stock indices hitting all-time highs during the month. This positive investor sentiment can be encapsulated in the current VIX level (around 15 to 16). The VIX is a measure of the broad U.S. stock market’s expectation of volatility and seeks to predict the variability of future market movements. The last time the VIX dipped to this level was the day before markets began to tank in February 2020, when COVID-19 panic overtook financial markets. The decline in this volatility measure, sometimes referred to as the ‘fear index’, supports the positive tone in the market.

Posted In: PostsMarket Updates