October 2023 Market Snapshot

Monthly Overview

Stocks fell in September, concluding a volatile quarter where investors experienced growing concerns that central banks might keep interest rates higher for longer. U.S. treasury yields reached their highest since 2007, while rising oil prices sparked a rebound in consumer prices. Both Canadian and U.S. stocks experienced declines during the month, with the S&P/TSX Composite Index sliding back to levels last seen in October 2020 and the S&P 500 Index suffering its worst month this year.

The S&P/TSX Composite Index was down 3.7% in September and declined 3.0% in Q3. Nine of the benchmark’s underlying sectors were negative during the quarter, led by telecommunication services (-13.8%) and utilities (-13.0%). Health care and energy were the only positive sectors for the quarter, with gains of 13.8% and 8.9%, respectively. Small-cap stocks, as measured by the S&P/TSX SmallCap Index, fell 1.5% for the quarter.

The U.S. dollar appreciated by 2.5% versus the loonie during the quarter, boosting the returns of foreign markets from a Canadian investor’s standpoint. Note that all returns in this paragraph are in CAD terms. U.S.-based stocks, as measured by the S&P 500 Index, fell 4.9% in September, and finished the quarter lower by 1.3%. The benchmark’s quarterly decline was led by utilities (-7.9%) and real estate (-7.5%). Energy and telecommunications services were the top gainers in the quarter, rising 14.0% and 5.3%, respectively. International stocks, as measured by the FTSE Developed ex-U.S. Index, declined 2.3% during the quarter, while emerging markets fell 0.2%.

The investment grade fixed income indices we follow posted losses in Q3. Canadian investment grade bonds, as measured by the FTSE Canada Universe Bond Index, were down 3.9% during the quarter. The key global investment grade bond benchmark was down 3.6%, while global high-yield issues were up 0.3% in Q3.

Turning to commodities, natural gas gained 4.7% in the quarter, while the price of a barrel of crude oil surged 28.5% in the same period. Gold, copper and silver all had a negative quarter with declines of 4.2%, 0.1% and 1.6%, respectively.

Inflation in Canada climbed to 4.0% year-over-year in August, marking the second consecutive month of acceleration in consumer prices since hitting the two-year low of 2.8% in June. The rise in prices was largely due to rising gas prices and higher rent costs. The Canadian economy added 40,000 jobs in August, as the nation’s unemployment rate held steady at 5.5%. The Bank of Canada continued its pause in interest rate hikes in September, keeping its key interest rate unchanged at 5.0%.

U.S. nonfarm payrolls rose by 187,000 in August, but the unemployment rate climbed to 3.8%. The consumer price index increased for a second consecutive month to 3.7% year over-year in August. A rise in oil prices over the past two months, coupled with base effects from last year, pushed inflation higher. The Federal Reserve held interest rates steady in September at a range of 5.25–5.50%, but signalled that we could see at least one more hike this year.

Content sourced from Bloomberg; data as at September 30, 2023.

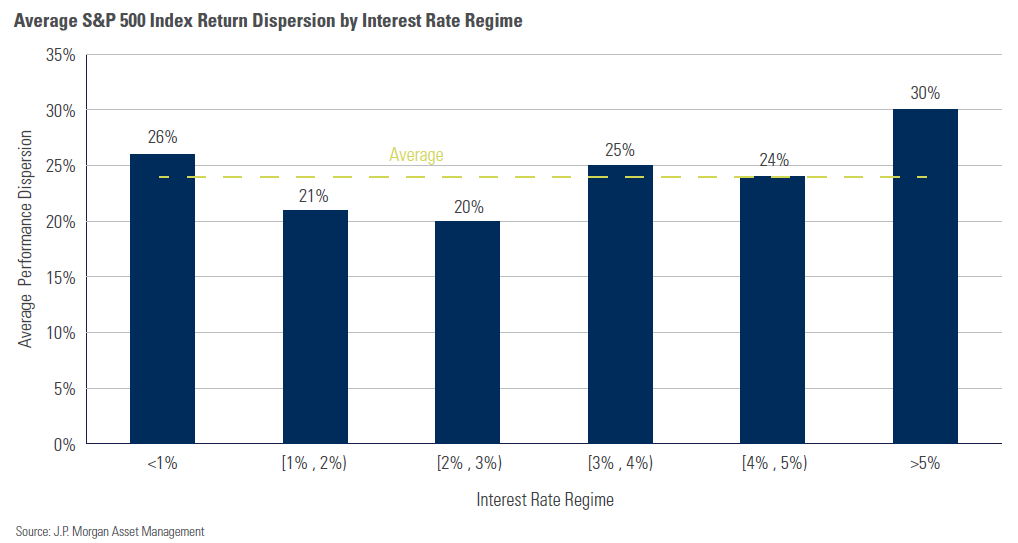

Chart of the Month: Opportunities for Active Managers?

Index return dispersion measures the difference between an index’s average return and the returns of each stock within that index. When there’s high dispersion, the gap between the best- and worst-performing stocks is significant, whereas, with low dispersion, the performance gap is small. This month’s chart illustrates the average S&P 500 return dispersion by interest rate regimes since 1996, on a rolling 12-month basis. Historically speaking, index dispersion for the S&P 500 has been highest when rates are above 5%. That’s where we are now. If rates remain higher for longer, and higher dispersion levels persist, more opportunities for skilled active managers to outperform the index also may exist. At the same time, there could be a greater opportunity for less skilled managers to embarrass themselves. Finding the right active managers isn’t easy, but ensuring a sound approach to screening managers and clearly understanding their investment process is a great way to start.

Posted In: PostsMarket Updates