Winter 2022 Newsletter

RRSP contributions should reinforce, not rearrange, your portfolio strategy

Are you looking to make a lump-sum contribution to your Registered Retirement Savings Plan (RRSP) this year? Maybe a top-up to increase a potential tax refund? Considering a loan to catch up on a backlog of unused contribution room? Any oneoff event like this can encourage us to go off-track when it comes to our portfolio strategy. We might consider this an ideal time to try something new or follow a trend we have noticed in the media. By doing so you can be getting in the way of your own success. Here’s why.

Remember that the strategy of your RRSP is designed to get you the returns you need in order to have the income you desire in retirement. Your portfolio’s investment mix takes your individual tolerance for risk into account and is diversified to maximize return potential while minimizing the risk of any single investment or investment type. An ill-conceived investment can upset that well-considered balance. If you’re tempted to stray from this optimized approach, consider one of these two alternatives:

Apply new money to your current mix – for now. This is the status quo option. Simply apply this year’s contributions to the current set-up, maintaining the existing proportions for now. At your next portfolio review, consider any new investment ideas in the context of your goals and risk profile and rebalance accordingly.

Park your money. If the above option doesn’t appeal to you this year, you can simply “park” your money by putting it into very safe or ultra-conservative investments for now. When you are ready for a portfolio review, consider new ideas and investments with your goals in mind and make any investment decisions prudently, not in haste. Your RRSP is one of the most powerful tools available to reach your retirement goals. It’s always worth taking the time to review your contribution plans as well as your investing strategy. We are here to help with either or both when you’re ready.

RETIREMENT

Eight questions to re-evaluate what retirement means now

Over the last year, chances are that you have found yourself discussing how the pandemic has led you, or your friends and family, to re-evaluate “what really matters in life.” If you are quickly approaching retirement, these are not just philosophical questions but ones of real practical and financial importance. In fact, they may be underpinning the financial assumptions in your savings and investment plans. With this in mind, consider how these eight key questions about retirement fit with your current state of thinking and the suggested financial considerations:

1. When will it happen? This is the one that the pandemic may have challenged the most. For instance, do you now have a desire to stop work earlier? Consider: Don’t rely on your emotions or assumptions. Running financial scenarios including income planning after retirement can give you some “real world” options to consider.

2. Will you work? In normal times, it can be hard to imagine stopping work altogether, and many Canadians express a desire to continue working in some capacity during retirement. After lockdowns, you may now have a better idea about how you will respond to a lot of time spent at home. Consider: Realistically evaluate what you might do for work post-retirement and make sure any new ideas are reflected in your financial plans.

3. Will you move? Travellers and snowbirds had their seasonal patterns severely disrupted over the last two years. All of us had to deal with much more time spent at home, for better or worse. If downsizing was a part of your retirement thinking, how do you feel now? Consider: Revisit your assumptions about housing, including factoring in the latest real estate values of both your current home and where you might move to.

4. What is your passion? Many retirement experts have long argued that having a sense of purpose – community, faith, work, family – is key to well-being in retirement. If you have never considered this, now is the time. If you have, did your priorities and passions shift recently? Consider: Every purpose or activity has financial implications, so think about what you need to support them in your income plans.

5. Who do you want around you? Missing loved ones has been a constant refrain throughout pandemic restrictions. Do you have a new emphasis on being nearer to those you care about? Consider: what financial resources are needed to ensure you are literally where you want to be in retirement?

6. Where will you go? Many retirement plans involve visiting or even moving to locations outside of Canada, including places with low costs and high adventure. Now, however, COVID-19 restrictions, health care facilities, and travel medical insurance issues may have all contributed to a different view of where you want to go. Consider: Check out the latest health and insurance information on destinations that are in your plans.

7. Why does it matter to you? Sometimes the elements of our retirement vision are just a continuation of what’s already in our lives or involve things that you believe you are expected to want in retirement. The past year may have led to a much deeper reimagining of meaning and value in your life. Consider: Don’t be afraid to challenge all the assumptions in your previous plans in order to create a retirement plan that matches your true desires.

8. How will you make it happen? A failure to plan is planning to fail, goes the old cliché. Consider: Bring your current thinking and goals to your financial and legal advisors. They have the skills and tools to put practical and financial strategies to work to help make life goals a reality.

Planning for your retirement years is only useful if those plans are built on what you really want in life. Once you know that you can build plans – including investment strategies – that are truly useful and can help make those desires a reality. If your goals have changed, it’s time for an investment review.

INVESTING

As the world responds to climate change, investment management evolves too

We are all becoming aware of the big changes that are necessary as we face the challenges of a warming planet. While much of the information in the media has focussed on our roles as consumers, commuters, and voters, what about in our investing lives? For a long time, this role has been limited to what’s available for those wanting to invest in “green” opportunities. But what is becoming clear is that climate change will lead to wholesale changes in many sectors, economies and geopolitical calculations that all investors will need to pay attention to.

Big tasks

Perhaps the biggest change in perspective that should be of concern to investors is the scope of the task and the time frame in which change must happen. Just a few years ago, experts who talked about catastrophic climate events likely by the end of the century now say those changes have arrived, making significant action necessary now. The International Energy Agency (IEA) has estimated that to meet the goal of a net zero-carbon world by 2050, the share of fossil fuels in the global energy supply would have to fall from its current 80% to 20% by 2050 – just 28 years from now. The Agency has estimated that reaching the goal of net zero-carbon on a global scale would cost $115 trillion.

Dynamics of transitions

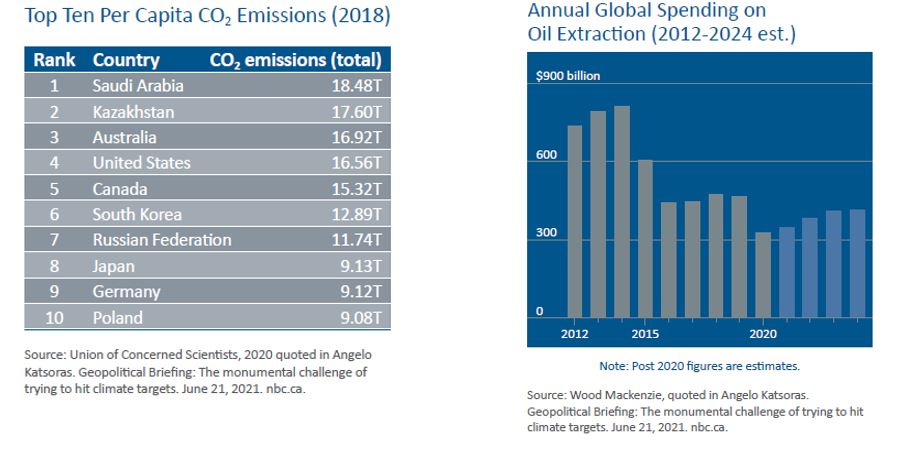

Changes at the economic and societal level to support these climate goals are complex and involve a staggering number of stakeholders and variables. Most well known of these is the tension between the developed and the developing economies about who should be making the biggest changes and who should finance the necessary action. While countries like China (the world’s largest emitter of greenhouse gases) and India are big emitters, the lifestyles of people in the West mean we remain among the largest per capita emitters (see table). Developing countries argue that they have the right to continue to develop and to have emerging middle classes demanding access to the same quality of life as those in Western economies, making reaching global goals on emissions even more difficult.

Troubled sectors

An obvious question for investors will concern the fate of companies in fossil fuel industries in the short and long term. Evidence of change in the global oil industry is evident already. As recently as 2014, oil investments by the world’s energy companies totalled about $807 billion. Consulting firm Wood Mackenzie has projected it will be only $348 billion in 2021 (see graph). The International Energy Agency (IEA) notes that, “Fast-evolving government plans to accelerate transitions towards a more sustainable future have created a high degree of uncertainty that is testing the oil industry.” Oil companies in the West have been facing growing pressure from environmentalists, investors, and politicians regarding climate change. Several global oil companies have lost legal cases or shareholder votes, forcing them to take a more aggressive approach to cutting emissions. These companies are unlikely to be able to achieve this goal without cutting production. Meanwhile, the Saudi national oil company spent much of last year threatening to topple Apple as the world’s most valuable company by stock market valuation. Clearly, these global oil giants aren’t going away anytime soon, but deeper knowledge than ever before – including climate science regulation and politics – will be needed to accurately assess their investment potential.

Rising industries

There will be new and rising industries in a de-carbonizing economy too. Obvious ones to consumers include wind turbine and solar panel production as well as electric car manufacturing. But it is not just the final products but the inputs into these products that will define the dynamics of the burgeoning green industries. A massive amount of minerals, such as lithium, copper and cobalt, will be needed in the transition to green energy. The typical electric car requires six times as many minerals to build as does a combustion-engine car, and an onshore wind plant requires nine times as many resources to build than a gas-fired plant. Understanding the dynamics of these industries, however, is not simple. For instance, while Chile is the largest extractor of copper, Indonesia the largest extractor of nickel and Australia the largest extractor of lithium, China is the biggest processor of all three, necessitating complex supply chains and geopolitical concerns. While the United States has significant deposits of lithium, challenges posed by environmentalists and Indigenous communities make mine approval slow and difficult. Deep industry and economic knowledge will be required to assess the investment opportunities in these industries of the green economy. The effects of climate change on how and where we should invest are quickly becoming part of the analysis that economists, market watchers, and investment managers undertake in their daily work. We can access all this thinking when managing your investments. If you’d like to know more, let’s discuss these issues at your next portfolio review.

FINANCIAL BRIEFS

Filing taxes? Remember pandemic support payments are taxable income

As you pull together all the usual slips and information to prepare for the tax filing season, don’t forget about the potential impact of the government’s pandemic support programs.

The most important thing to know is that income from all Government of Canada pandemic support programs for individuals is taxable. This includes the original Canada Emergency Response Benefit (CERB) as well as its replacements the Canada Recovery Benefit (CRB), the Canada Recovery Sickness Benefit (CRSB), and the Canada Recovery Caregiving Benefit (CRCB). If applicable, you should receive a T4A from the federal government detailing the income you received from any and all of these programs. Note that no funds were withheld for taxes in these programs. The amount of tax you ultimately pay on them will be determined by your overall marginal tax rate when you calculate and file your 2021 tax return.

The federal government also introduced a number of programs to support Canadian businesses during the COVID-19 pandemic. Generally speaking, the payments from these programs, such as the Canada Emergency Wage Subsidy (CEWS) and the Canada Emergency Rent Subsidy (CERS), are taxable income. If you are a business owner of any kind, be sure to seek out professional tax advice to manage these tax issues.

New year, new view of your financial life

Improving your finances is a perennial new year’s resolution. If you are taking stock of your finances as the new year begins, there is an easy method to get an overall snapshot of your financial health: calculate your net worth.

A net worth statement is a summary of what is owed (assets), less what is owned to others (liabilities). Your assets will include the value of your investment portfolio, the value of your home, vehicles, and possessions, while liabilities comprise items like your outstanding mortgage balance, car payments and any other debts. It is useful because it takes in all your finances, not just the common items you may think about such as your investments or your mortgage balance.

Remember there is no “right answer” or magic number. But understanding your net worth can be helpful with those financial resolutions. For instance, you may have a home with a high value but if it’s matched by a very high mortgage balance, it is not adding much to your net worth overall. Paying the mortgage down may become a financial goal for you.

Increasing your net worth over time is a worthy financial goal. Your savings and investing strategies can play a big role in getting there. We’re here to help!

RESPs are well known but not well understood

While a large majority of Canadians – 92% – are aware of Registered Education Savings Plans (RESPs), only 17% say they’re knowledgeable about the contribution limits and benefits they offer, according to a recent study.

The study, which surveyed 1,510 Canadian adults online in August 2021, found that more than 80% of Canadian parents say they don’t understand the benefits of this savings tool. RESPs provide several advantages for Canadians saving for their children’s or grandchildren’s education. The money you contribute and invest grows tax-free within an RESP. Plus, the federal government supplements your contributions with the Canada Education Savings Grant (CESG), which could provide an extra $500 in free money every year if you contribute the maximum. Proceeds from RESPs are not just for university but can be used for a wide variety of qualifying education programs at community colleges, CEGEPs, trade schools and other educational institutions.

Among respondents aware of RESPs, just under half (49%) currently contribute or have contributed to one, with an average total contribution of about $22,800. If you’d like to learn more about this powerful savings tool, please contact us.

This newsletter has been written (unless otherwise indicated) and produced by Jackson Advisor Marketing. © 2022 Jackson Advisor Marketing. This newsletter is copyright; its reproduction in whole or in part by any means without the written consent of the copyright owner is forbidden. This is not an official publication of iA Private Wealth and the information in this newsletter does not necessarily reflect the opinion of iA Private Wealth Inc. The information and opinions contained in this newsletter are obtained from various sources and believed to be reliable, but their accuracy or reliability cannot be guaranteed. The opinions expressed are based on an analysis and interpretation dating from the type of publication and are subject to change. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. Readers are urged to obtain professional advice before acting on the basis of material contained in this newsletter. Mutual funds are not guaranteed and information on returns is based on past performance which may not reflect future performance. Mutual funds may be associated with commissions, trailer fees, management fees and other expenses. Please read the prospectus. Important information regarding mutual funds may be found in the simplified prospectus. To obtain a copy, please contact your Investment Advisor. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates. iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. Only products and services offered through iA Private Wealth Inc. are covered by the Canadian Investment Protection Fund.

Posted In: PostsNewsletter